The Innovator's Dilemma by Clayton Christensen describes how new entrants, often with simpler and less expensive offerings, can challenge established businesses by initially targeting underserved segments of the market, eventually displacing incumbents as they improve and move upmarket.

This idea is central to SNAK’s thesis. We’re focused on categories that have historically been slow to adopt and therefore have been underserved by technology (e.g., manufacturing, agriculture, construction). These are massive categories, so it’s important to note that within these categories we believe the most successful marketplaces will start by building for “niche” market segments.

Andrew Chen doubles down on this idea in his book the Cold Start Problem, specifically in his discussion of “atomic networks”. An atomic network is the smallest, self-sustaining network that can serve as a foundation for larger, more complex networks. It's the initial, dense group of users where a product can prove its value and gain traction before broader expansion.

At the earliest stage of investing, these micro-network patterns are far more important than big top line numbers. This is why when founders ask us what the minimum GMV is that we look for when investing we don’t have an answer. A $100k GMV business with strong cohorts >> a $1M GMV business with weak cohorts. Density >> scale.

The surprising thing about atomic networks is that they are often much smaller than you would think. In pitch decks we often see market sizing in terms of geographies or verticals or demographics. However, when we’re evaluating an idea at the seed stage we’re actually seeking to understand very specific context and use cases for 10s of buyers/sellers that create value for both supply and demand.

As an example, Lenny Ratchinsky (early product lead at AirBnB) discusses Uber’s atomic network here:

…Uber, whose networks we tend to talk about as “San Francisco” or “New York,” but in the earliest days, the focus was on narrow, ephemeral moments—more like “5pm at the Caltrain station at 5th and King St.” The general managers and Driver Operations had an internal tool, called Starcraft—referring to the real-time strategy game popular at the time—that allowed them to click on a group of cars, text them “Go to the train, lots of riders!” and direct them in real time.

For B2B marketplaces atomic networks often emerge in tightly bounded contexts — a single city, company, industry vertical, or specific use case — where usage is concentrated and connections naturally form. Here are 5 B2B marketplace examples of atomic networks:

Grainger - founded in 1927 and focused on electric motors. The company now sells a broad range of industrial products and generated $17B in revenues in 2024.

EquipmentShare - Initially focused on renting construction equipment in Columbia, Missouri (their hometown).

Flexport - Started as “turbotax” (specific use case) for cross-border logistics, specifically China to US.

Workrise - Focused geographically (Texas) and vertically (oil & gas).

GrubMarket - Initial focus on Bay Area farms + local grocers and restaurants.

If you’re building a marketplace for a niche we’d love to learn more, and promise we won’t pass due to “market size”. Reach us at contact@snak.vc.

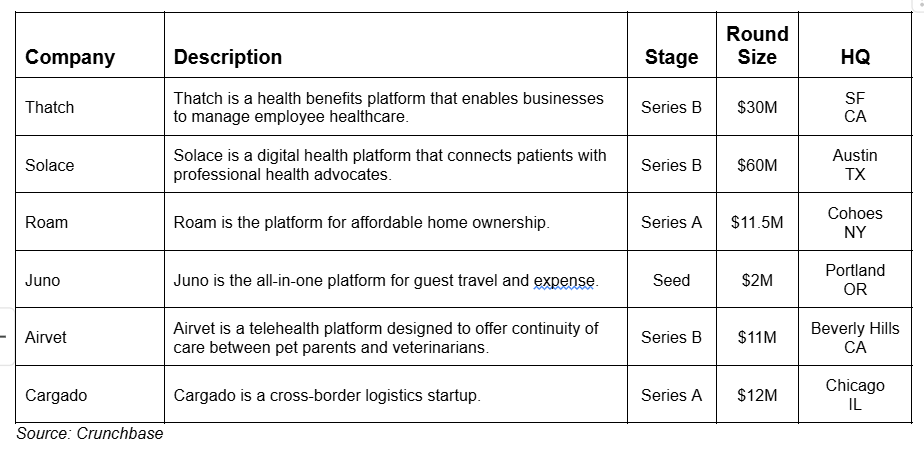

Weekly Deals

What We’re Reading

The Atomic Network - Lenny Ratchinsky - link

Cold Start Problem - book link

Marketplace Memo #9 - Colin Gardiner - link

Meet with us

We’re on the move, and love to meet with founders and investors in person. Reach out to contact@snak.vc:

April 29 - May 1 | Palm Springs - investor meetings

May 22 - 23 | NYC - we will be at VSC’s Dirty Jobs Summit and would love to meet with founders and investors before and after

June 25 - 27 | Indiana - Great Lakes Venture Summit

By concentrating on a single metro, our belief is that a developed self-sustaining ecosystem where supply (growers), servicers (contractors), and end customers (homeowners) transact seamlessly across our tech-enabled platform creates the greatest outcomes. That density created network effects, trust loops, and logistical efficiency that would’ve been impossible with a spray-and-pray national rollout.

Ironically, that same focus often gets misread by investors who over-index on scale metrics or geographic footprint. But as this piece smartly notes, atomic networks look small—until they’re not.

An ecosystemic approach requires immense complexity in its solution to support all within it. The measure should therefore be the balance within all the components in equal growth there within. What kpi that falls under is beyond me, but I'm sure VC nomenclature will grasp it soon enough.

Great post Sonia! Clearly illustrates how successful marketplaces start hyper-focused before expanding. I'm curious - at what point do you recommend founders shift from deepening their atomic network to expanding outward? Is there a specific signal or metric that indicates the right moment to pursue adjacent networks, or is this more art than science?