#06 Procurement Led Marketplaces

We’ve previously talked about our B2B marketplace thesis, our interest in recycling, and now want to share another theme we’re excited about – procurement led marketplaces.

Historically, many marketplaces we’ve invested in have been supply driven– startups have hacked the supply side first and then marketed that inventory efficiently online to find initial buyers. We’re now seeing a trend in B2B marketplaces that are demand driven– enabled by AI, startups can now focus on automating/super-powering the procurement function. These startups are starting with an enterprise customer, using a company’s bill of materials to create targeted outreach to vendors, and then using technology to gather multiple quotes and help buyers combine an assortment of vendors to get the lowest aggregate price. In the past, automating the procurement function would require extensive manual effort, complicated logic, and humans in the loop for error handling. AI has the power to streamline all of this. Once initial transactions are completed these new marketplaces also have more credibility to sign vendors up for their online platforms and to charge sellers a take rate when net new buyers are identified and closed.

By providing supplier information and pricing all in one place, procurement marketplaces help businesses save time, identify new sources of supply, reduce costs, and improve operational efficiency. In addition, there are compliance benefits from centralization – procurement marketplaces can help businesses keep track of transactions, sourcing composition, and make audits and traceability easier.

The concept of more efficiently leveraging demand and supply networks to broker transactions is not a new behavior. In fact, in several very large verticals human brokers and trade agents facilitate transactions (spoiler alert: these are the verticals most likely to disrupted first). According to IBIS, the U.S. wholesale trade agent and broker industry was $774.5 billion in 2024. Wholesale trade agents and brokers often focus on niche markets, catering to specific products or industries. The specialization allows them to serve targeted customer bases with tailored services and networks of buyers/sellers. This results in the industry being highly fragmented. No wholesale trade agent or broker has more than 5% of total category revenue. Food and automotive-related industries are the biggest markets for wholesale trade agents. Within these broader markets, canned and packaged foods, and used automobiles represent the largest sub-markets.

The 2 largest companies in the space are:

C&S Wholesale Grocers ($30B 2024 Revenue) - Grocery supply

Ferguson PLC ($27B 2024 Revenue) - Plumbing and heating products distributor

Are you building a procurement-led marketplace, possibly using AI? If so, we’d love to hear from you: contact@snak.vc.

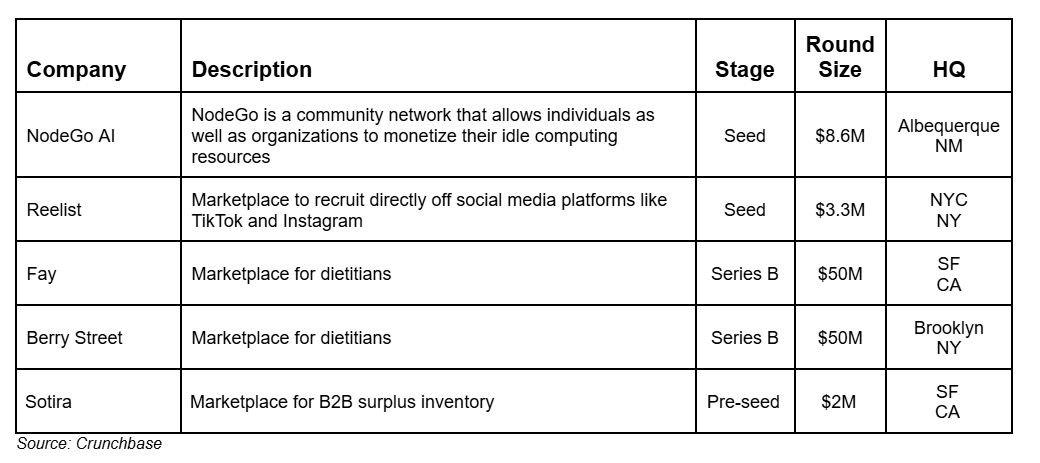

This Week’s Marketplace Deals

What We’re Reading

Colin Gardiner’s Marketplace Memos - A great roundup of all things marketplaces: Link

The DeepSeek moment for eCommerce - How AI is shaping the future of online marketplaces: Link

Lyft to start offering driverless rides in Dallas as soon as next year - Advances in technology could bring down the cost side of services marketplaces sooner than one might think: Link

Trump Introduces Tariffs on Steel and Aluminum: This has ripple effects for the manufacturing and construction sectors, both opportunities and challenges: Link