#04 Embedded FinTech in B2B Marketplaces

A big part of the "why now" for today's B2B marketplaces

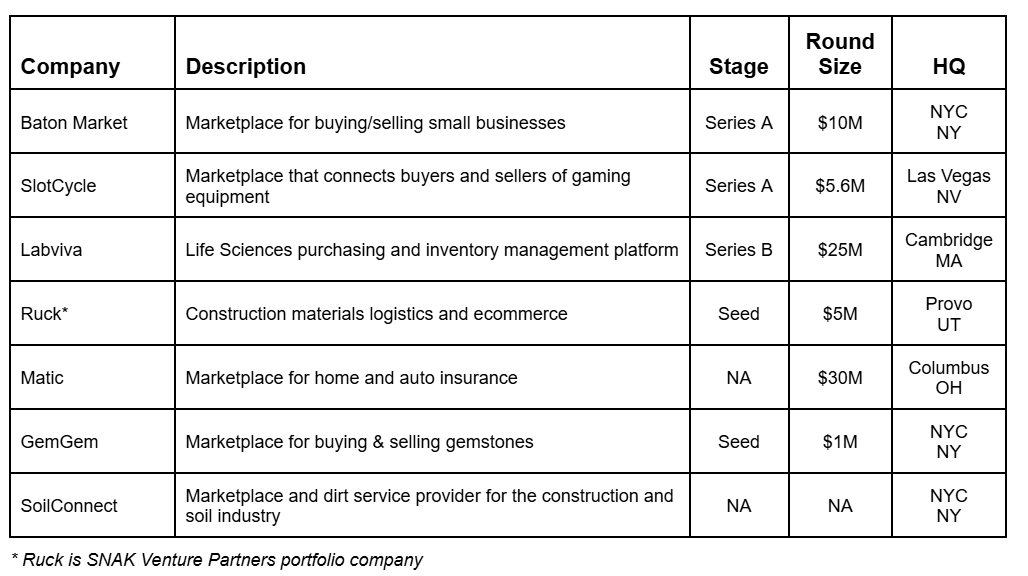

For B2B marketplaces, either early on or at scale, embedded financial services become an unlock for growth. This is a big part of “what’s changed” and the “why now” which underpins our thesis in B2B marketplaces.

Being in the Payment Flow

FinTech companies such as Stripe (founded 2010) and Plaid (founded 2013) have made it easier for startups to be “in the flow of payments”. Being in the flow of payments is one of Bill Gurley’s 10 factors to look at when evaluating digital marketplaces (post written in 2012). He points out that it is much easier to extract a take rate when you are in the flow of payment vs. trying to bill and collect from a supplier after a transaction has been completed (psychologically more painful for suppliers / more likely to be viewed as a “tax”, and logistically more painful for the startup needing to be a bill collector). Being in the flow of payments also enables startups to enforce policies that thwart fraud, create a concept of escrow, and ultimately build trust.

Interestingly, Bill Gurley also wrote (in 2012):

Unfortunately, some industries (like autos) just are not set up for this type of arrangement, as the payment likely lives at the end of a long purchasing process.

In 2012 “a long purchasing process” (which is common in larger B2B transactions) was difficult to service via online transactions. While autos is called out as an example of a challenging industry, Carvana (founded 2012) and ACV Auctions (founded 2014) went on to become multi-billion dollar public digital marketplaces in the auto industry. This is a good reminder that in venture there are no hard and fast rules, because technology is constantly changing what’s possible.

The central point is true – in many B2B industries payment terms (e.g., net 30, net 60) are built into processes to allow time for delivery and inspection of goods before payment. This can create challenging cash flow dynamics for small companies. Startups can attempt to (1) collect money up front and hold the money in escrow (creating a positive cash dynamic for themselves), or (2) line up payment terms with customers and vendors (ideal but not common). For new marketplace entrants that haven’t yet built trust with buyers/sellers, these options are typically non-starters. Most early-stage companies must (3) provide buyers ample time for inspection of goods (e.g., 30 days) while paying suppliers promptly on delivery of goods. In turn, many B2B marketplace startups end up becoming short term lenders to customers. The resulting negative cash flow position is exacerbated when startups are growing quickly. A few things to note if you end up in this situation:

Customer credit worthiness: Everything is grand until a customer goes out of business and can’t pay. If your AOV is small, this may be a risk worth taking. But if you have a large AOV it’s helpful to either check credit as part of your buying process (if someone has low creditworthiness you can require instant payment) or get insurance to reduce your cash risk (e.g., trade credit insurance). In the early days of building, there are startups like Get Balance that take on underwriting and credit checks as part of their B2B payments product suite.

A/R Line: As you grow, waiting on customer payments can become a bigger drain on cash and constrain capital you can invest for growth. This is an ideal situation to get an Accounts Receivable line of credit (a loan that uses your outstanding invoices as collateral). For high growth companies this can be a great source of non-dilutive funding.

Factoring: In a similar vein as the A/R line, factoring is another way for startups to finance growth. Factoring involves selling A/R to a third party. With an A/R line, the business retains ownership of the invoices, while with factoring, the invoices are sold to the factor and the factoring company becomes the new owner. In an A/R line, the business repays the loan amount with interest, while with factoring, the business pays a fee on each invoice collected by the factor. Factoring can be more flexible as businesses can choose which invoices to sell, while an A/R line might require submitting all outstanding invoices as collateral. Factoring may have a less negative impact on a business's credit score compared to taking out a loan on an A/R line, as it is considered a sale of assets rather than a loan. A/R lines are more suitable for businesses with good credit who need short-term access to capital and want to maintain control over their receivables. Factoring is ideal for businesses with poor credit or experiencing cash flow issues, as it allows them to quickly access cash by selling their outstanding invoices even if customers haven't paid yet. Given the assumption of collection risk that factoring companies are assuming, factoring receivables is typically more expensive than leveraging an A/R line.

Becoming a Lender for Vendors

Digital marketplaces that can provide faster, reliable payment terms for vendors provide a compelling reason for moving online. While payment speed helps, a bigger unlock for vendors can be access to additional capital. With more capital, vendors are able to purchase more inventory and, in turn, sell more in a marketplace. Marketplaces potentially have some unique advantages as a potential lender– they already own the vendor relationships (no acquisition cost) and they usually have proprietary data (e.g., sales volume, demand potential) that they can use for underwriting. There are a number of great examples of this - either vertically integrated or built via partnerships: Shopify Capital, Open with Faire, Equipment Share Financing with Bevel, ACV Auctions Capital.

Are you building a fintech product for marketplaces? If so, we’d love to connect you with our portfolio companies, potentially feature you in our newsletter, and help you find customers. Reach out to us at contact@snak.vc.

Let’s Meet in Person

2/26: We will be at the Everything Marketplaces Meetup in Austin and would love to connect with founders there: https://lu.ma/6c2xfd91

Nice take. Concur. Matium is doing exactly this and is quickly becoming the unified credit facility for the raw materials supply chain.